2021 sees the need for an acceleration in the transformation of wealth management IT systems. A study from Ernst and Young in 2019 showed that a third of clients plan to switch wealth management providers over the next three years. Insufficient personal attention and advisory capabilities were cited as the main reasons for customers leaving.

The traditional wealth advisor relationship must be considered, and growth in self-service tools will be required to support the newer investment channels. Smarter tools are vital for wealth management companies to enable advisors to create a better service for their clients. Such tools are likely to involve the use of AI and machine learning techniques to maximize information around customer needs, behaviours and data to hyperpersonalize, reinvent the market, and enable investments to fit individual customer circumstances.

Modernisation Pitfalls

Historically, attempts to modernize applications have often failed for wealth management companies. Let’s take a closer look at three main pitfalls which have hindered success along with our recommendations on how to best mitigate these risks:

No user-centric approach for AI

Acceptance of new systems by advisors and customers have failed because systems may not be designed around end user needs. Consequently, AI solutions often fail to create understandable and trustworthy personalization for the customers or the advisor. This results in a lack of confidence in the financial advisor and causes customers to look elsewhere and advisors to fall back on their traditional approach of using their own experience.

Technical challenges with AI applications

Infusing AI into wealth management systems presents many technical implementation challenges. Bespoke solutions are often too cumbersome, difficult to understand, not repeatable and have resulted in higher IT costs and time to implement changes. This is a major barrier to digital modernization, and the inclusion of explainable and usable AI.

Lack of end-to-end AI strategy

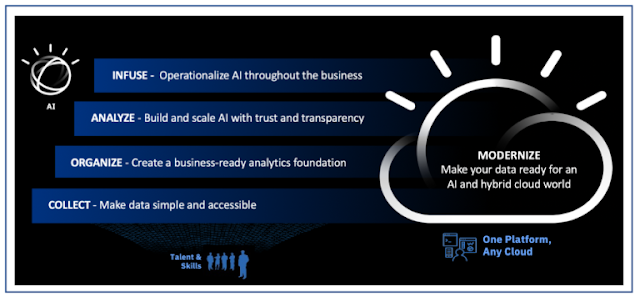

Getting value out of AI is not easy. According to MIT Sloan, 40% of organizations making significant investments in AI do not report business gain. Often, companies focus too much on the Data Scientists and clever algorithms in the belief that this alone will bring success, rather than looking at the full end to end process which would deliver the true outcomes they require. Whilst Wealth management organizations have long understood that AI is an essential, they have not followed a proper AI framework.

Tactics to win with AI Best Practices

To combat a lack of trust and confidence in AI, agile methods such as IBM Design Thinking aim to center your focus on user needs. Such methods involve multiple brainstorming sessions at the beginning of the project with client advisors and customers to align AI to the main pain points and system desires for end users.

Prototyping and iterating on these ideas should follow before formulating solutions. When it comes to customer attrition, clients need a smarter system to help prioritize which customers needed attention, and immediate notification when a customer is at high risk of leaving. To truly embrace AI, advisors want a smarter system they can trust – a system which produces AI output they can explain and understand.

The Data Science and AI Elite (DSE) developed machine learning models which identify and provide insight to customers who are at risk for attrition. Design Thinking helps validate which functionality is most relevant and to address the issues of operational acceptance.

Rather than adopting bespoke, non-repeatable deployment approaches for AI based applications, IBM Cloud Pak for Data addresses challenges by offering a single platform to deploy all AI applications. It offers a wide range of services, including AutoAI to automate the model building approach and Watson Studio to allow for ethical and explainable AI.

0 comments:

Post a Comment