Cloud costs are on the rise, affecting profit margins, revenue, and the total costs of goods sold. As organizations scale, achieving efficiency becomes imperative.

In a recent IBM Institute for Business Value report, 79% of stakeholders said their top-priority digital plays require comprehensive, advanced cloud capabilities. Many businesses have shifted their focus to a hybrid multicloud approach to take advantage of the benefits of cloud.

But a conventional approach to IT finance no longer serves a purpose and needs to be re-evaluated and redesigned.

Why the old IT finance playbook doesn’t cut it

Soaring cloud costs and diminishing value create extremely challenging conditions for CIOs, exposing the limits of a conventional approach to managing IT finance and procurement. Cloud no longer requires capital planning and budgeting once a quarter — it demands attention to services procurement and consumption on a per-hour or even per-second basis. By the time the IT finance team gathers at the table, the company’s economics have already changed.

In a new hybrid cloud environment, financial management becomes an integrated function of the business’s economic decision-making. The old siloed way of working between infrastructure, development, and IT finance teams no longer works.

Financial management is pushed out of governance into operations, where engineers and finance act as one, collaborating early and often. Knowledge of IT economics becomes table stakes across every part of IT. Procurement processes are automated and contracts are structured to allow for vendor elasticity.

FinOps becomes essential as it establishes processes, the culture and new habits, while providing full visibility for all clouds. With FinOps, operational metrics and business outcomes come into play. It’s about cost avoidance first, with optimization second.

CIOs can do a lot in response to cost increases, but there are limits to what they can achieve on their own. Their efforts will be most beneficial when they bring together IT, finance, procurement teams and business.

The price tag of innovation

Even as enterprises embrace the many benefits of the cloud, managing the cost of cloud computing can be a challenge. According to Gartner, over 60% of IBM infrastructure and operations leaders report significant public cloud cost overruns that negatively impact their budgets.

The attractive economics of cloud can become diluted by the cost of migration, modernization, and platform construction. Companies may lose potential savings as cloud sparks demand for more services, the price of which are steadily increasing. Workload migration plans can be confusing with cloud strategies, as digital transformation initiatives often proceed with no clear cloud integration. Moreover, companies might implement cloud tech without making the necessary operational changes to take advantage of the cloud suite.

The IBM report further found 79% of executives place high importance on cloud cost management tools that run across multiple clouds, maximizing the cloud’s value by avoiding unnecessary costs.

It’s little wonder that addressing the cost of cloud has climbed the senior management agenda. In a 2021 predicted cloud’s share of IT spend to grow 5% by 2024, with hybrid and multicloud alone making up 17% of IT spending. Surveyed executives expect their organizations to operate more than 10 distinct clouds by 2023, up from 8 in 2020. Surveyed executives expect their organizations to operate more than 10 distinct clouds by 2023, up from 8 in 2020.

The economics of this pivot are significant. In its first months post-adoption, cloud delivers on the promise of agility, access to an all-you-can-eat buffet of services, immediate access to infrastructure, and new digital products that deliver monetary value. But without appropriate guardrails and a process change, this fast cloud adoption and scaling of cloud-based products leads to excessive pressure on margins, outweighing the touted benefits.

Living up to the cloud hype

So why are cloud costs on the rise? There is no singular answer. Developers’ increasing demand and freedom to launch services across clouds is one obvious driver. The hype around “public cloud” is another. (A better way to approach infrastructure overhaul is to find the right workload for the right cloud.)

Finally, myriad services, complex and confusing pricing models, unexpected price hikes and the scale of new development all make cost management an arduous task.

CFOs increasingly note that going “all-in on public cloud” without appropriate cost controls has raised the total cost of revenue and goods sold. Many companies have started pursuing hybrid cloud strategies as one way to ensure the most appropriate placement for applications, which in turn helps lower the overall total cost of ownership.

Business growth often slows with scale, and operational efficiencies become a key determinant value in public markets.

Redesigning the playbook

Following conventional IT finance methods for decades is a tough habit to break. A portfolio of solutions is required to provide granular visibility into technology’s impact on the company balance sheet.

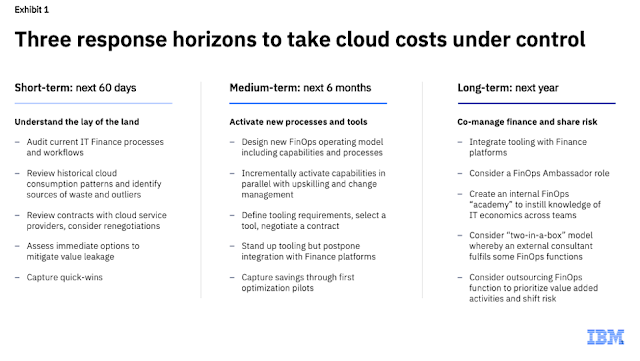

When designing and implementing such an effort, it’s useful to think about three main blocks of activity across short, medium and long-term horizons.

Short-term actions (next 60 days)

The first step for any organization is to get a comprehensive understanding of the real underlying costs of its IT operations — not just cloud, but the entire technology plant. A major life sciences company, for example, employs a dedicated data scientist to conduct a thorough analysis of the output from cloud-native billing tools. Using this data, it creates a granular, component-by-component view of the likely spend outliers or “bad behaviors” of the development teams.

The organization should also embed a third-party observer (internal or external) into the IT finance, procurement and development teams to map out the processes and flaws in existing workflows. Leaders can use this information to come up with a future IT finance strategy, vendor management strategy and optimization opportunities. They can also identify opportunities to rapidly reduce costs through quick changes in how cloud environments operate (e.g., automatically shutting down resources after they are idle for a certain period).

Medium-term actions (next 6 months)

After this orientation, leaders can double down on efforts to redesign and rebuild the internal workflows and processes around financial management — how costs are tracked, aggregated, alerted and reported out to business owners, development teams and senior leadership. This cannot be achieved without building new capabilities outside the conventional playbook. For some companies, it may be enabling chargeback. For others, it may be establishing a way to reconcile budgets with the master budget. Most importantly, it will require building a FinOps “muscle” and knowledge of cloud economics throughout the IT team.

By building out new capabilities and processes, CIOs can deliver step-change improvements in IT and finance operations. One IBM banking client redesigned its entire IT finance function to activate 20 new cloud FinOps capabilities and take advantage of extreme automation, AI/ML and advanced analytics. With the help of this solution, the bank increased cost efficiency of cloud deployments by 30% without affecting the function of applications and systems.

Upskilling everyone in IT to be FinOps-conversant is key. A biomedical research organization, for instance, has established a FinOps academy and dedicated resources for continuous education on IT economics to train developers, product owners and business and financial analysts.

Companies can also take advantage of the modern FinOps and observability tools to further enhance cost controls and establish a “single pane of glass” management console. But the redesigning process always comes first. Tools just reduce reliance on disparate and convoluted cloud-native billing systems.

Longer-term actions (next year or two years)

Over the longer term, companies may want to focus on what’s important: building new products and innovating with the business, not managing IT finance processes and coordination with many engineering teams. This process begins with a re-evaluation of in-house FinOps versus managed-services decisions.

Rapidly rising cloud deployments, the size of the cloud bill (which can reach billions of rows), everchanging complexity and pricing models for services across cloud providers are already driving a shift in how the new IT finance playbook is implemented. Some companies seek to maintain some control and oversight of the process and choose a two-in-a-box model, with third-party FinOps experts embedded in teams. Others outsource the FinOps function to technology consultants who can build the bridge between IT, finance, and procurement, linking with existing systems such as SAP and Workday.

Maximize cloud value while avoiding costs

Cloud is here to stay, but companies must maintain profit margins, stay competitive in established markets and execute operational efficiencies. The CIO is at the heart of this. A new generation CIO will decisively change the way teams create new cloud solutions with IT economics in mind. As IT financial management becomes ingrained into all aspects of the workplace, it will be in the CIO’s best interest to maintain profit margins and reduce the total cost of revenue and total cost of goods sold.

Cost savings start with the right workload placement, and the conversation around hybrid cloud is picking up speed as it allows CIOs to moderate costs while delivering the required performance. Accurate cost models, integrated tools and observability across the technology plant give product, engineering, procurement and finance teams the methodology to realize possible savings and capture the business value expected by the CEO, the board and Wall Street.

Source: ibm.com

0 comments:

Post a Comment