IBM works with our insurance clients, and research conducted by the IBM Institute for Business Value (IBV) shows three key imperatives that guide insurer management decisions:

1. Digital orchestration

2. Improved core productivity (business and IT)

3. The need for flexible infrastructure

To meet the key imperatives and facilitate the transformation of their companies, insurers need to:

- Provide digital offerings to their customers

- Become more efficient

- Use data more intelligently

- Address cybersecurity concerns

- Strive for a resilient and stable offering

To achieve the above-mentioned objectives, most insurance companies have prioritized digital transformation and IT core modernization, using hybrid cloud and multi-cloud infrastructure and platforms. This approach can accelerate speed-to-market by providing enhanced capabilities for developing innovative products and services, facilitating business growth and improving the overall customer experience in their interactions with the company.

IBM can help insurance companies insert generative AI into their business processes

IBM is one of a few companies globally that can bring together the range of capabilities needed to completely transform the way insurance is marketed, sold, underwritten, serviced and paid for.

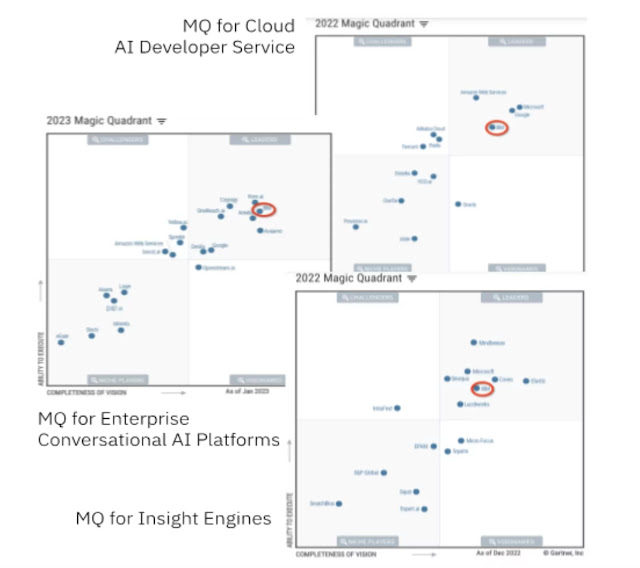

With a strong focus on AI across its portfolio of products and services, IBM continues to be an industry leader in AI-related capabilities.

IBM watsonx AI and data platform, along with its suite of AI assistants, is designed to help scale and accelerate the impact of AI using trusted data throughout the business.

IBM works with several insurance companies to identify high-value opportunities for using generative AI. The most common insurance use cases include optimizing processes that require processing large documents and large blocks of text or images. These use cases already represent a quarter of AI workloads today, and there is a significant shift towards enhancing their functionality with generative AI. This enhancement involves extracting content and insights or classifying information to support decision-making, such as in underwriting and claims processing. Focus areas where the use of generative AI capabilities can make a significant difference in the insurance industry include:

- Customer engagement

- Digital labor

- Application modernization

- IT operations

- Cybersecurity

IBM is creating generative AI-based solutions for various use cases, including virtual agents, conversational search, compliance and regulatory processes, claims investigation and application modernization. Below, we provide summaries of some of our current generative AI implementation initiatives.

Customer engagement

Providing insurance coverage involves working with numerous documents. These documents include insurance product descriptions detailing covered items and exclusions, policy or contract documents, premium bills, receipts, submitted claims, explanations of benefits, repair estimates, vendor invoices and more. A significant portion of customer interactions with the insurance company consists of inquiries regarding insurance coverage terms and conditions for various products, understanding the approved claim payment amount, reasons for not paying the submitted claim amount and the status of transactions such as premium receipts, claims payments, policy change requests and more.

As part of our generative AI initiatives, we can demonstrate the ability to use a foundation model with prompt tuning to review the structured and unstructured data within the insurance documents (data associated with the customer query) and provide tailored recommendations concerning the product, contract or general insurance inquiry. The solution can provide specific answers based on the customer’s profile and transaction history, accessing the underlying policy administration and claims data. The ability to instantly analyze large amounts of customer data, identify patterns to generate insights and anticipate customer needs can result in greater customer satisfaction.

We are currently developing several use cases, which include:

- Obtaining prior authorization for medical procedures

- Administering health benefits

- Explaining claims decisions and benefits to policyholders

- Summarizing claims history

Insurance agent/contact center agent assistance

Insurance companies have widely deployed voice response units, mobile apps and online web-based solutions that customers can use for simple inquiries, such as balance due inquiries and claim payment status checks. However, the current set of solutions is limited in functionality and cannot answer more complex customer queries, as listed under customer engagement. As a result, customers often resort to calling the insurance agent or the insurance company’s contact center. Generative AI-based solutions designed for agents can significantly reduce document search time, summarize information and enable advisory capabilities, leading to productivity improvements ranging from an average of 14% to as high as 34% and increased customer satisfaction. IBM has been implementing traditional AI-based solutions at insurance companies for several years, using products such as IBM watsonx Assistant and IBM Watson Explorer. We are now starting collaborations with a few insurance companies to incorporate foundation models and prompt tuning to enhance agent assistance capabilities.

Risk management

To make underwriting decisions related to property, insurance companies gather a significant amount of external data, including the property data provided in insurance application forms, historical records of floods, hurricanes, fire incidents and crime statistics for the specific location of the property. While historical data is publicly available from sources such as data.gov, well-established insurance companies also have access to their own data underwriting and claims experience data. Currently, using this data for modeling risk involves manually-intensive efforts, and AI capabilities are underutilized.

A current initiative by IBM involves collecting publicly available data relevant to property insurance underwriting and claims investigation to enhance foundation models in the IBM watsonx AI and data platform. This approach will be used by our insurance company clients, who can incorporate their proprietary experience data to further refine the models. These models and proprietary data will be hosted within a secure IBM Cloud environment, specifically designed to meet regulatory industry compliance requirements for hyperscalers. The risk management solution aims to significantly speed up risk evaluation and decision-making processes while improving decision quality.

Code modernization

Many insurance companies with over 50 years of history still rely on systems developed in the 1970s, 1980s and 1990s, often coded in a mix of Cobol, Assembler and PL1. Modernizing these systems requires converting the legacy code into production-ready Java or other programming languages.

IBM is working with several financial institutions using generative AI capabilities to understand the business rules and logic embedded in the existing codebase and support its transformation into a modular system. The transformation process uses the IBM component business model (for insurance) and the BIAN framework (for banking) to guide the redesign. Generative AI also aids in generating test cases and scripts for testing the modernized code.

Addressing industry concerns related to using generative AI

In a study conducted by IBV, business leaders expressed concerns about the adoption of generative AI. The major concerns relate to:

- Explainability: 48% of the leaders IBM interviewed believe that decisions made by generative AI are not sufficiently explainable

- Ethics: 46% are concerned about the safety and ethical aspects of generative AI

- Bias: 46% believe that generative AI will propagate established biases

- Trust: 42% believe generative AI cannot be trusted

- Compliance: 57% believe regulatory constraints and compliance are significant barriers

IBM addresses the above concerns through its suite of watsonx platform components: IBM watsonx.ai AI studio, IBM watsonx.data data store and IBM watsonx.governance toolkit for AI governance. Specifically, watsonx.governance provides the capabilities to monitor and govern the entire AI lifecycle by providing transparency, accountability, lineage, traceability of data, and monitoring of bias and fairness in the models. The end-to-end solution provides insurance company leaders with features that enable responsible, transparent and explainable AI workflows when using both traditional and generative AI.

As described above, we have identified many high-value opportunities to help insurance companies get started with using generative AI for the digital transformation of their insurance business processes. In addition, generative AI technology can be used to generate new content such as articles (for insurance product marketing), personalized content or emails for customers, and even content generation like programming code to increase developer productivity.

IBM works with clients to show significant productivity gains when using generative AI:

- Talent: Achieve 30%-40% productivity gains

- Customer: Shift 50%-70% of all interactions from phone to various digital channels and use generative AI to drive this transition

- Code generation: Realize a 30% productivity improvement in code migration and modernization

Source: ibm.com

0 comments:

Post a Comment